We wrote last month about clean products being far too strong for crude to sit idly by. This did not take too long to correct, with Oct WTI rallying from $80/bbl up to intraday highs over $93/bbl in just three weeks, dragging Brent up with it into the mid 90s. Crude spreads have also done their bit to dampen the clean product cracks down from extreme levels.

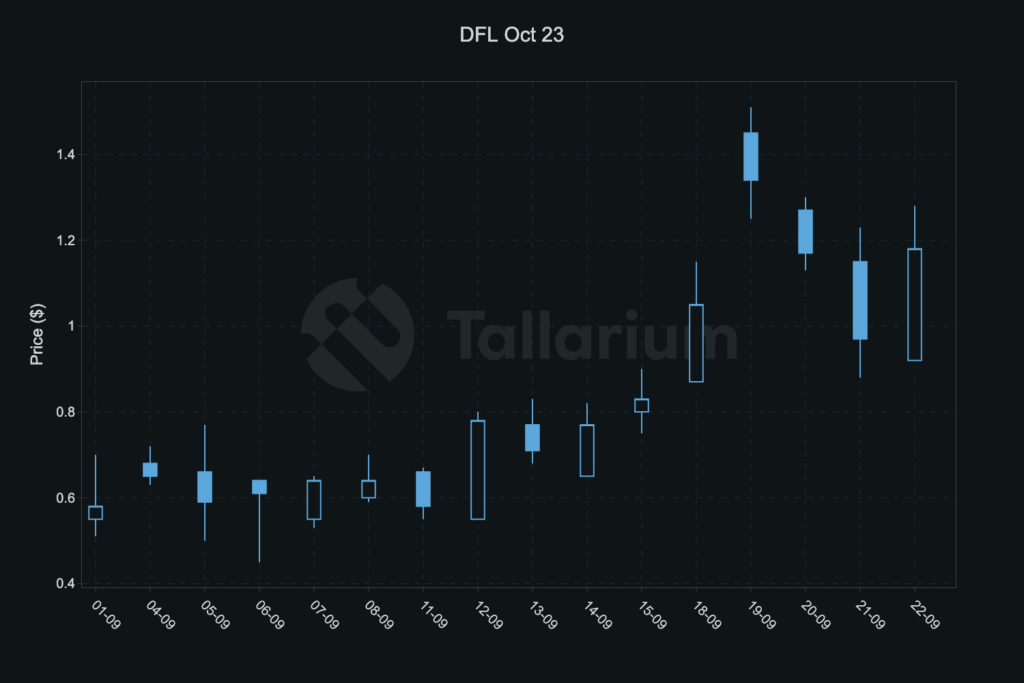

The price action in the October DFL nicely reflects the urgency with which the market chased crude higher this month, sequentially gapping up to highs of $1.40/bbl on Tuesday 19th September, possibly on the back of stop-outs. Clean products have not kept up with crude as this has played out with prompt gasoil cracks pulling back into the high $30s, while the October EBOB crack is trading in under $15/bbl, down almost $5/bbl in just over a week.

Despite the move this month, margins are still incentivising refiners to run max into year end and the Saudis seem intent on keeping supply tight, leaving fundamental traders still justifiably bullish. Crude however has done a lot of work over very little time to bring the oil price set back into a more logical range. Perhaps now is a good time to take stock and revaluate before positioning for the next move (higher?).

Oct 23 DFL

Light Ends

Gasoline remains seasonally very strong. Despite the pullback in prices, the winter EBOB spreads are still in extreme backwardation and stocks are depleted across all price centres. RBOB and 92R paint a similar picture in the US and Singapore. The recent flat price rally may eventually make a dent in demand in some locations, but there is no evidence of this just yet. Spreads and cracks are now back where they were in early August, which are by no means low levels. Looking ahead at the winter values, cracks and spreads could be prone to corrections lower, particularly as the market struggled to rally on the back of ostensibly bullish European refinery outage headlines. Naphtha is backward but the cracks are now a drag on refinery margins, with Oct 23 Nap NWE Crack sinking to -$13/bbl largely as a function of stronger crude.

Distillates

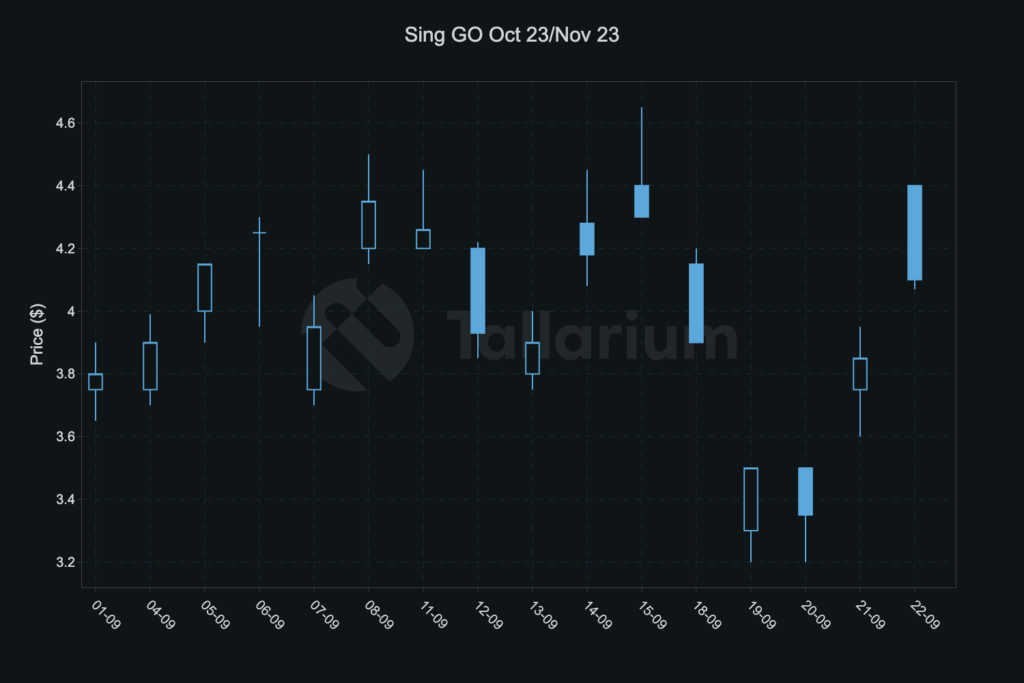

Distillate values have also eased off from recent highs but the complex remains more resilient than gasoline. Spreads remain steeply backward across all price centres in line with the low stock environment. The Oct/Nov Sing Gasoil attracted decent selling around $ 4.50/bbl, but Tallarium data showed stacks of bids clustered to own the spread at $3.25/bbl and values since bouncing back to around $4.25/bbl on this prompt spread.

Oct23/Nov23 Sing GO

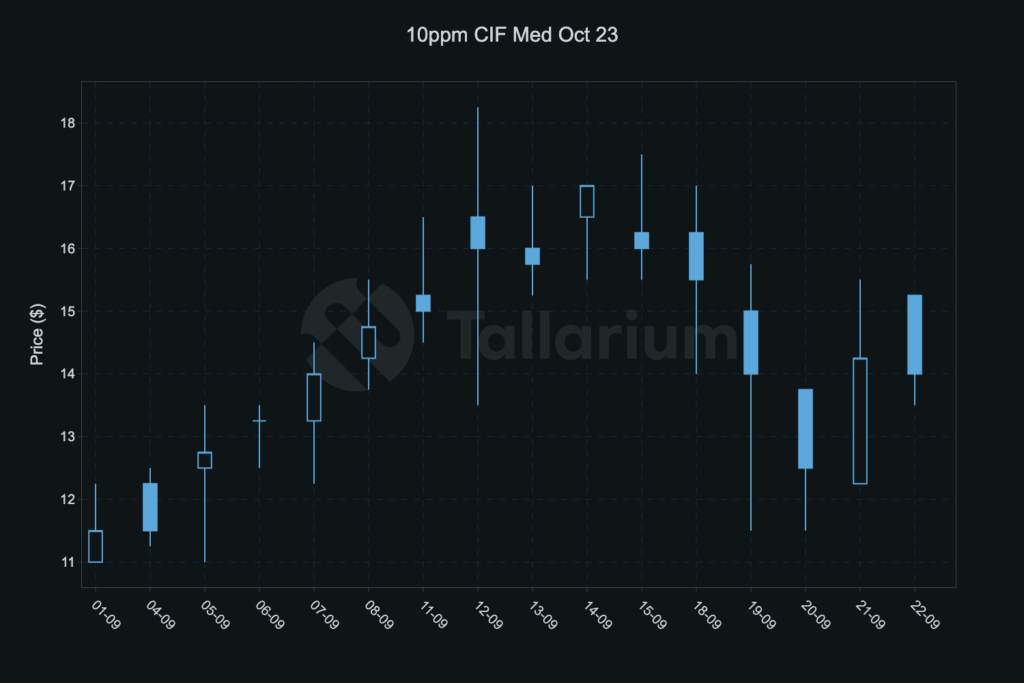

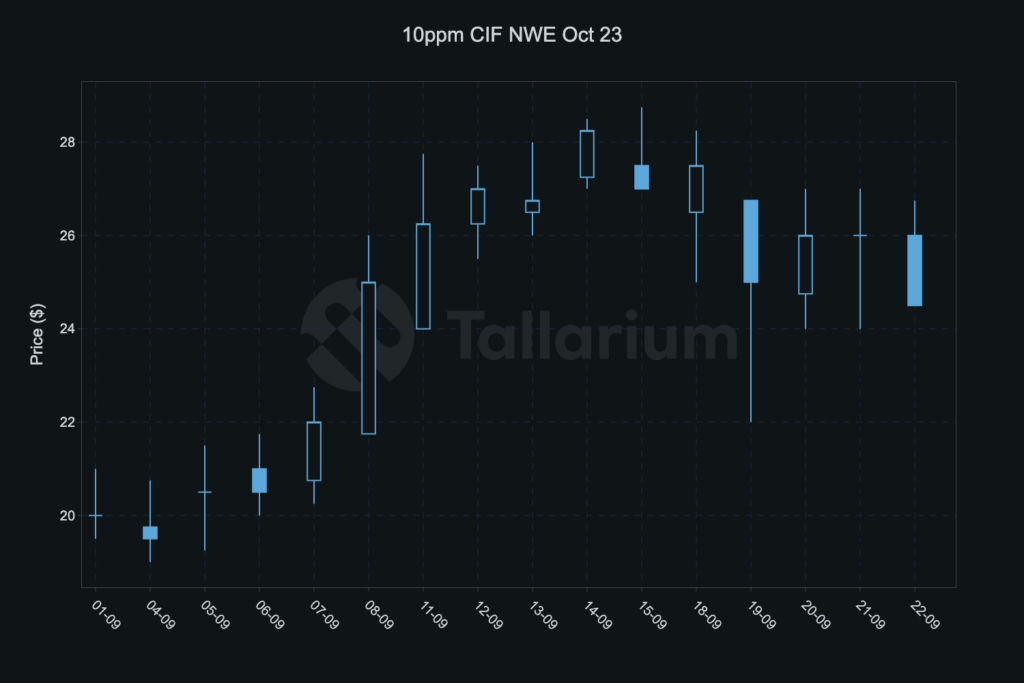

In Europe, the widening East/West through August allowed traders to hedge larger arb cargos to Europe from the East. This goes some way to explaining the selling in the Oct 23 10ppm CIF Med from $17/mt down to $12/mt as these make their way through the Suez. The cargos in NWE however are not relenting, with the Oct 23 10ppm CIF NWE popping back up into the mid 20s on the back of the recent unplanned outage at Shell Pernis. This is doing enough to attract re-supply from the US East coast to Europe, which should ensure PADD1 stocks remain bottom of the range ahead of the winter. Overall, we have more conviction on being long distillates over gasoline at these levels going into the winter.

Oct 23 10ppm CIF Med

Oct 23 10ppm CIF NWE