As oil markets settle into the new normal of reduced transit through the Red Sea, price action has become less erratic. TC5 has not made new highs, European Jet Fuel (a market hugely dependent on Asian re-supply) has come down dramatically and Gasoil cracks have been on the decline. Crude spreads have rallied significantly, but they did start the year at very low levels.

February was a textbook example of the see-saw between Crude and products playing out to get everything somewhat back to acceptable levels. Now Brent Crude is back at $80/bbl, the Crude structure is mildly backward and clean products still highly backward. That said, the macro indicators for oil demand do not look particularly encouraging. The IEA is forecasting oil demand growth in 2024 to be only roughly 1.2%, which is half of what we saw in 2023.

In the absence of further geopolitical risk escalation, Crude will likely require further tightness in clean products to push higher. With the US coming out of peak refinery maintenance, this may take some more time to manifest, which means we could see Crude flat price continue to stay in the current range or drop lower.

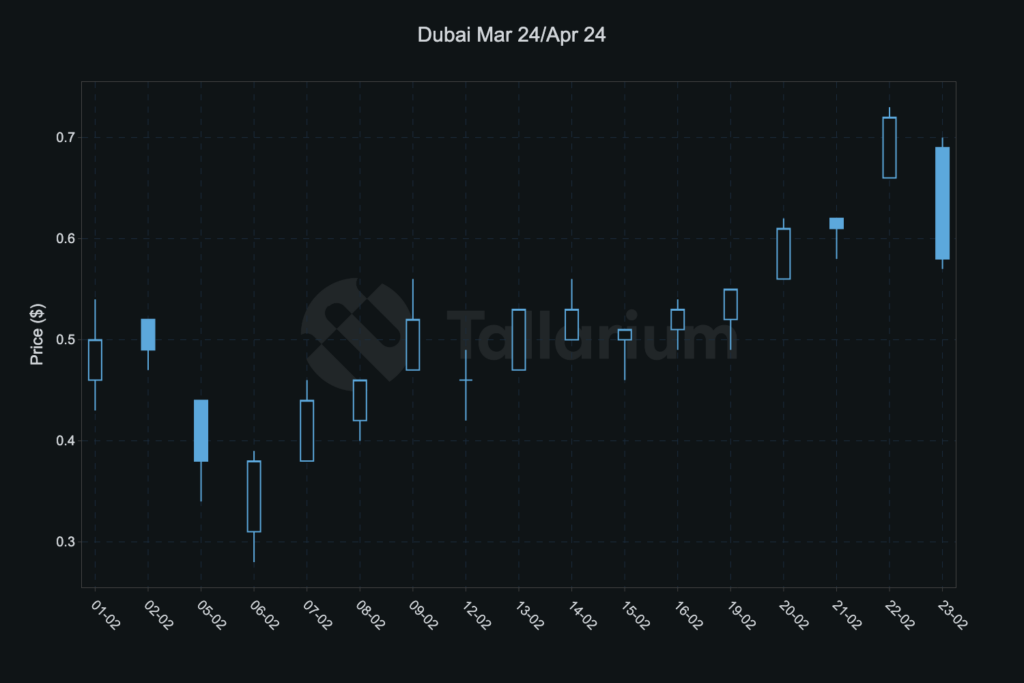

Dubai structure, like Brent and WTI, has gotten stronger through Feb but appears to be wobbling now

Light Ends

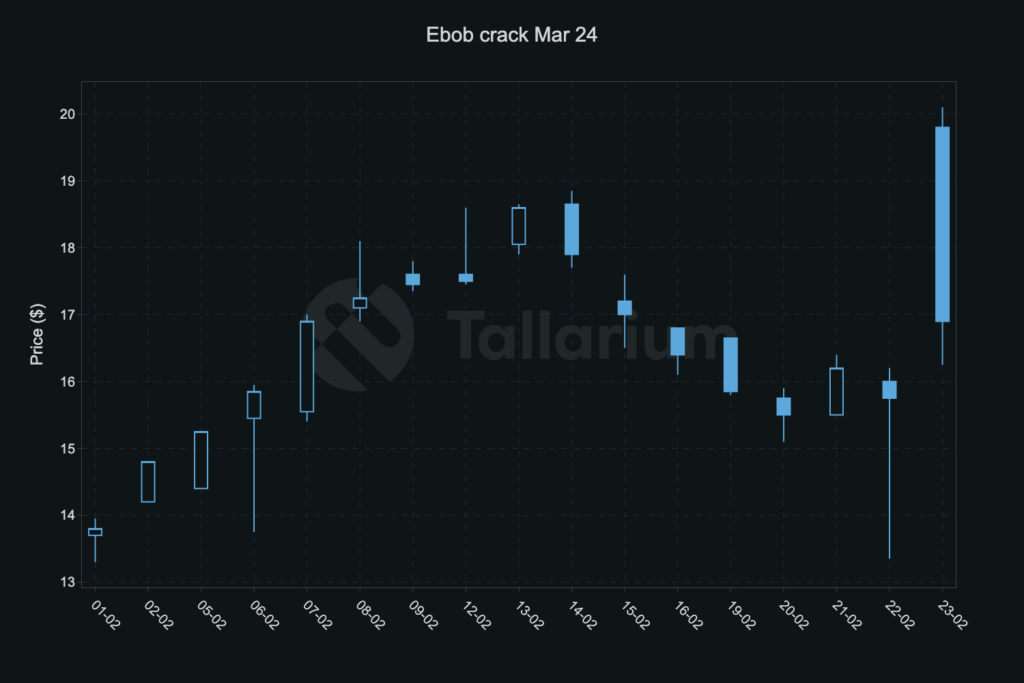

Gasoline is the steadfast crack across the barrel with Ebob leading the way. Cracks have firmed to new highs despite the performance in Crude structure. As we enter March, the market will be focused on trading Q2 products and Rbob performance will be required for sustained strength from what are already elevated levels for Ebob. In what’s been dubbed as the year of elections, there are plenty of parties interested in keeping the gasoline price in check.

Ebob cracks made new highs in mid-February and our pushing higher again despite the rally in Crude spreads

Distillates

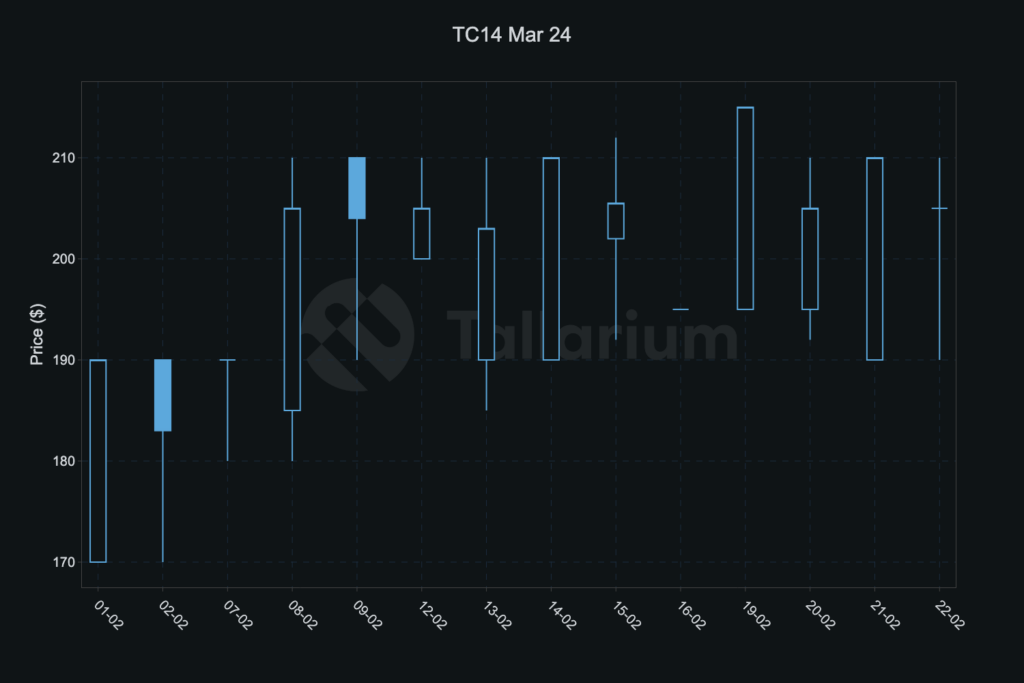

OTC indicators for Distillates have been on the retreat over the past fortnight. Singapore time spreads, 10ppm CIF Med and Gasoil cracks have all eroded in value. A lot of the run-up in price in late Jan and early Feb was on fears that the shooting match in the Red Sea would lead to a genuine shortage in the supply for CIF markets in NWE and the Med. Barrels have evidently been able to reach these homes either via the Cape or from opportunistically increased exports from the USGC. The US oil market does not miss the opportunity to monetise these price shocks, and you would be hard pressed to find a better example of that than this month.

TC14 spiked above 200ws in the back half of Feb, as the market rushed to secure MR freight to ship Distillates into a spiking Med market

Conclusion

We warned last month about the risk of the market getting overly bullish on the geopolitical headline traffic over year-end and January. Speculative inflows into product futures, particularly Distillates, picked up in Feb and Crude tried to rally on a few occasions, but despite the continued exchanges between the Houthis and US/UK forces, flat price seems to be firmly anchored around the $80/bbl mark. This is the fair value at which the market appears comfortable, but there is a big question mark over demand as 2024 plays out.

As traders convene around Shepherd Market this week for International Energy Week, the market appears settled, but questions remain around what will drive the sentiment as Q2 positions are built up. Will Gasoline continue to power on through the spring? Can this carry the margin in the face of strengthening Crude spreads? Will Diesel follow Jet lower in the face of increased global runs and poor demand indicators? Bulls will need compelling answers to these questions for the market to kick on.