Overview

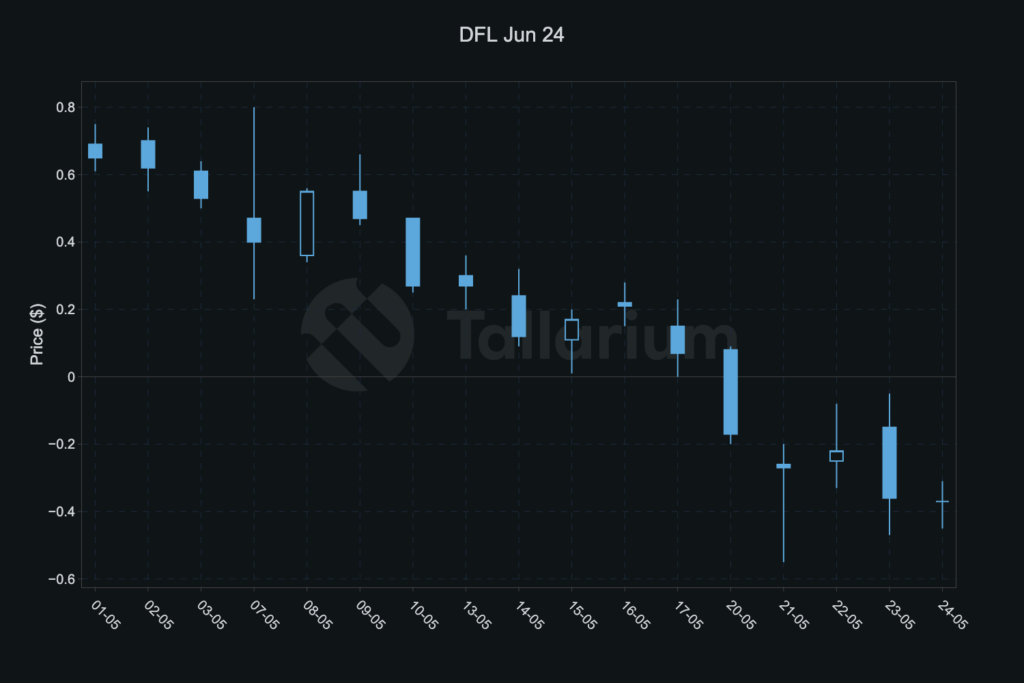

The oil market has been uncharacteristically subdued this month. Flat-price Brent has slipped back to lows within the $80 to $90 range it’s been trapped in since the start of the year. Taking their cue from Distillates, Crude spreads have run out of steam, with values sinking into mild backwardation at $0.30 to $0.40 per spread. Dated differentials, such as Jun DFL trading -$0.40/bbl, suggest Brent spreads may have yet further to fall. Even Gasoline seems to be faltering just before the looming US-driving season. With fewer geopolitical headlines driving volatility, traders are now focusing on supply and demand balances. Middle Distillates are building, in large part due to weak economic growth and huge supply additions east of Suez. These fundamentals are unlikely to change over the summer. In June, macro attention will pan over to the flurry of upcoming general election results, which may begin to set the tone for markets in 2H 2024. The risk of geopolitical escalations in the Middle East should not be overlooked however.

Light Ends

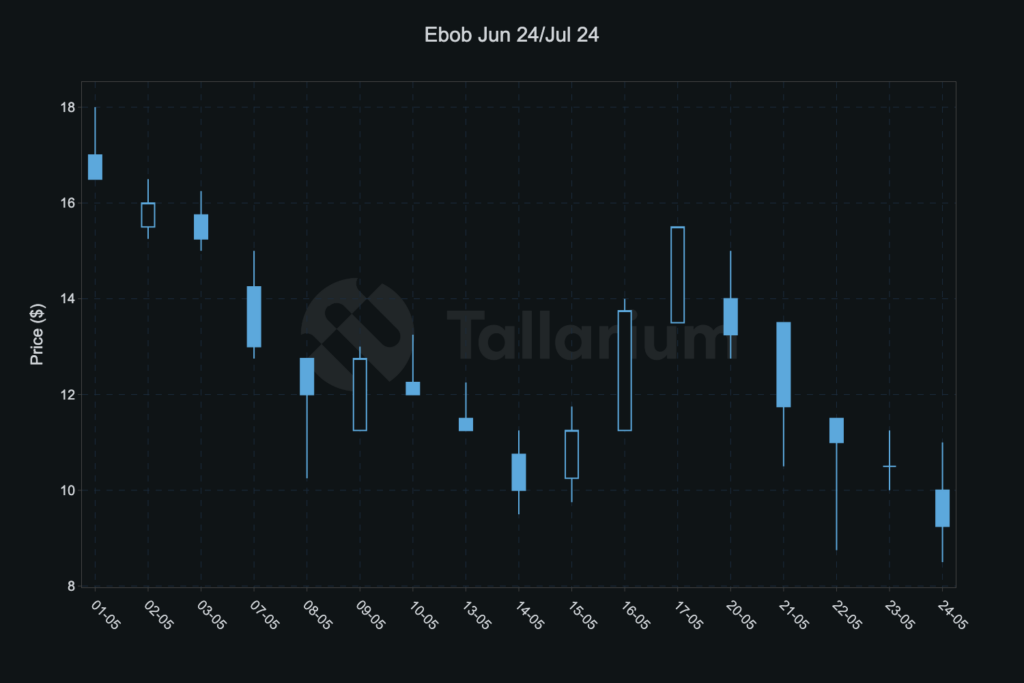

In last month’s report, we noted that Gasoline prices had been bulletproof. This trend has reversed in May, with significant declines in Gasoline contracts globally. The Jun/Jul Ebob spread dropped sharply to $9.25/mt, down from mid-month highs of $15.25. Singapore’s prompt gasoline spreads have also fallen from $1.75 to $0.25 since the beginning of May. Although Gasoline remains in backwardation and is faring better than Distillates, its future performance will heavily depend on strong US demand during the peak driving season. The impact of weaker Gasoline on margins cannot be ignored.

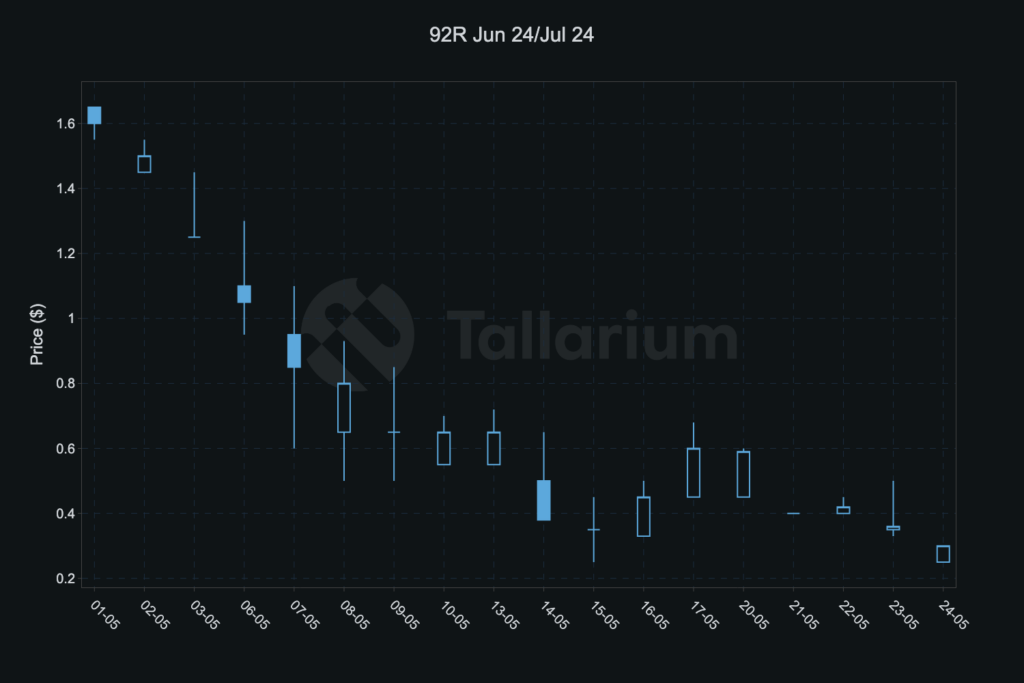

Distillates

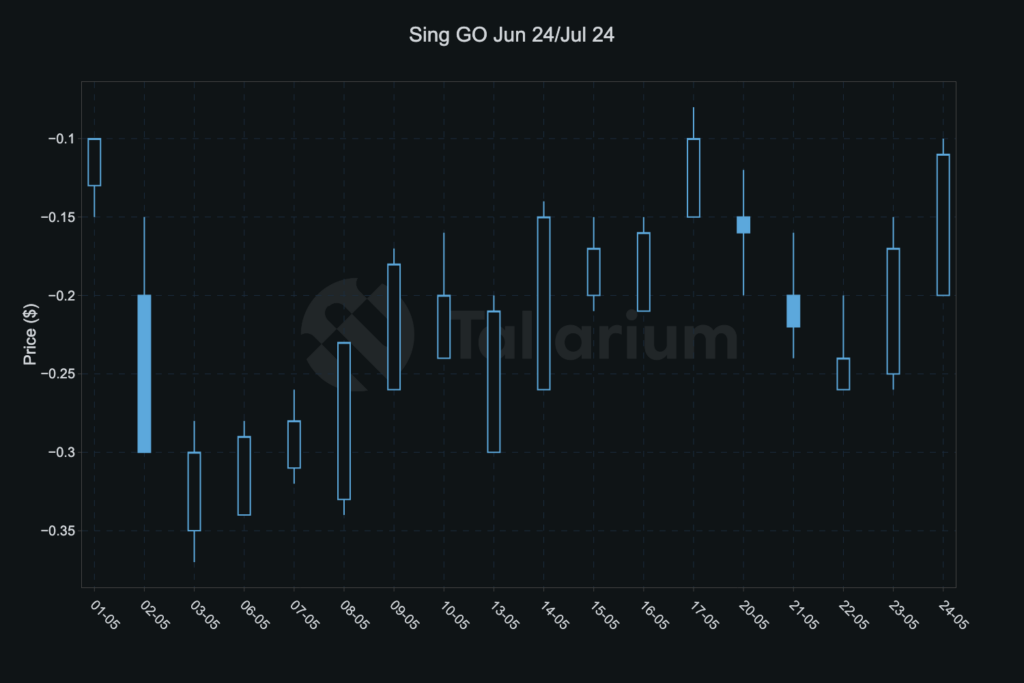

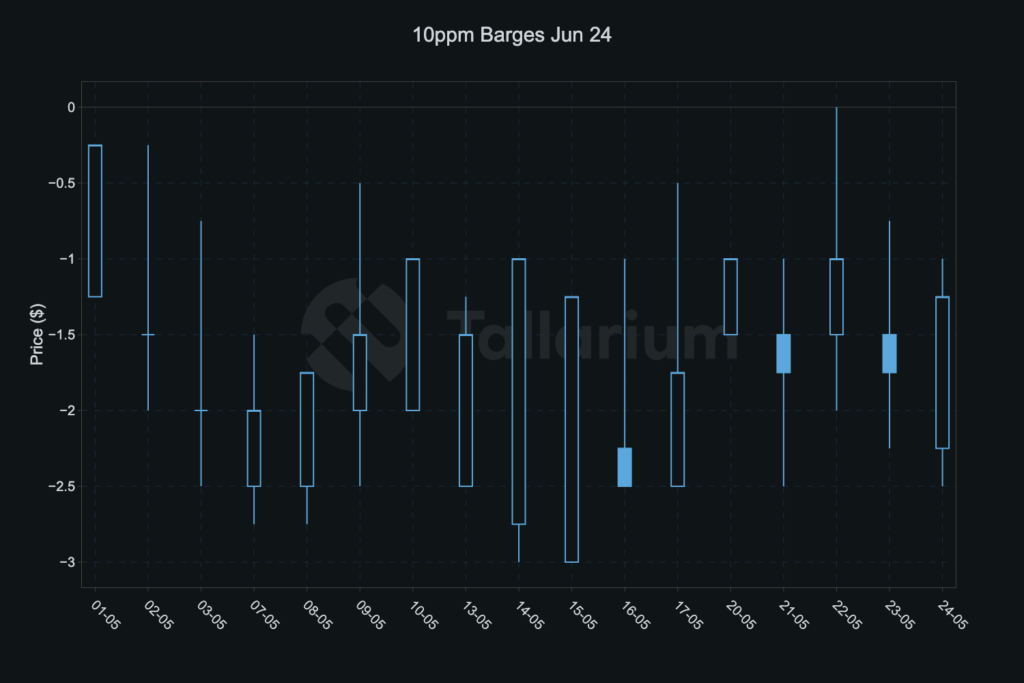

As tempting as it will have been to buy spreads at flat or modest contangos on the move downwards, traders may need to wear or roll these positions for some time yet before seeing the upside. Stocks are creeping up across the pricing centres now, and as runs increase globally, Middle Distillates can continue building. US Distillate demand is reported by the EIA as being approximately 240kbd lower YoY. All in all, it’s been a range-bound month for the key Distillate values. Q3 ICE Gasoil cracks are oscillating around $20/bbl, while spreads are maintaining their prompt contangos. Jun/Jul ICE GO is at $-2.50/MT and Jun/Jul Sing GO -0.15/bbl. The June barge diffs in ARA are well priced at $-1.50/MT, validating the contangos seen on the screen. Meanwhile Jet Fuel has turned a corner spurred by strong demand and deep contangos. Singapore Kero spreads are off their lows, whilst EU Jet diffs back on their feet.

Conclusion

The oil market has entered a phase of relative stability with Brent crude prices confined to a narrow range and key spreads showing limited movement. Gasoline, which had shown resilience earlier in the year, has now seen significant price drops globally, dependent on strong US demand as the driving season approaches. Middle Distillates continue to build due to weak economic growth and increased supply, resulting in subdued prices. Despite the potential for limited downside if inventory build rates remain low, traders may decide to maintain their positions for longer for returns to manifest. Patience may be rewarded, but caution must always be taken with position sizing when volatility is likely to return in the second half of the year.